Date Minimum Wage

Current $8.25/hr

January 1, 2020 $9.25/hr

July 1, 2020 $10/hr

January 1, 2021 $11/hr

January 1, 2022 $12/hr

January 1, 2023 $13/hr

January 1, 2024 $14/hr

January 1, 2025 $15/hr

This minimum wage increase will cost the state over $1 billion because current employee contracts will go up as a result. This increase will also drive up costs to local schools, universities, non-profits, park districts, day care centers, and many others. All of these costs will be passed along to local taxpayers, many in the form of higher property taxes. Rushing through a minimum wage increase in this manner will drive businesses from Illinois, especially in communities close to the state line.

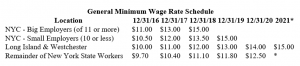

“Treating the rest of the state as if it has the same strengths as Chicago is simply illogical,” Rob Karr, IRMA’s president, and CEO said to the Daily Herald. “No one else has 55 million visitors a year.” They argued for a regional alternative — a $15 rate in Chicago within five years, a $13 rate in the suburbs within seven years and an $11 rate for downstate communities within five years. The state of New York voted a minimum wage increase similar to the plan that IRMA suggested as can be seen in the chart below:

Rockford has long been known for its manufacturing. One business contacted me last week. This manufacturing company has been in business here for over 40 years. It employs 250 people and, instead of layoffs, cutting employee benefits or raising prices, this business will be moving to Wisconsin as soon as possible.

When Governor J.B. Pritzker took office last month he spoke of bipartisan cooperation while the state tackles the challenges still facing it. With the House currently made up of 74 Democrats and 44 Republicans, yesterday’s vote of 69 to 47 clearly fell along party lines. Many Republicans expressed their concern during the House debate before the vote that none of them were asked to the table to negotiate the terms of the bill. Enhanced tax relief for small businesses and other pro-business reforms may still need to be addressed to mitigate the damage done by this legislation.