State Representative Joe Sosnowski, R-Rockford, has signed on to co-sponsor House Resolution 153 today, legislation stating opposition to any measure that would allow for the creation of a graduated income tax on Illinois residents.

Representative Sosnowski issued the following statement after the Capitol press conference introducing the resolution:

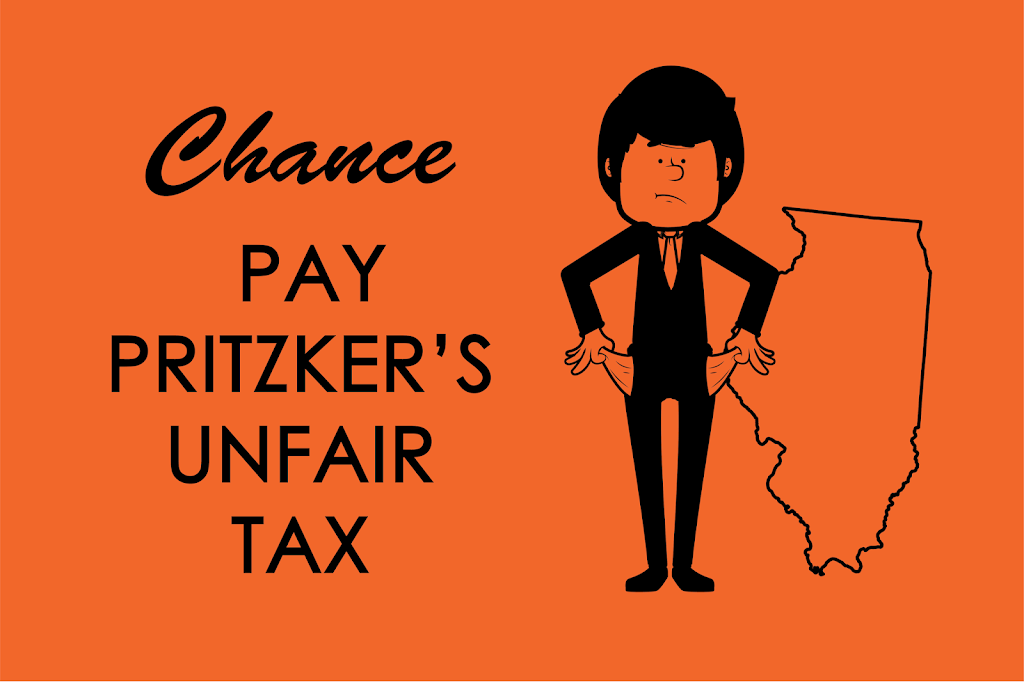

“Stateline area families are not going to be fooled. Moving to a graduated tax would be like handing over a blank check to the government. Illinois families already pay the highest overall tax burden of any state in the Midwest, and among the highest in the nation. Enacting a Graduated Income Tax, with rates set by politicians in Springfield and subject to change at any time, would result in a tax hike on middle-income families and hasten the exodus of jobs and opportunity out of Illinois. It’s very telling that the Governor and his allies in the legislature will not say what the rates would be under their Graduated Income Tax plan. They are deliberately hiding the rates until after the 2020 election to surprise Illinois taxpayers with the truth about how much higher your taxes will really go. The Governor had referenced states like Iowa, where their residents pay 6.12% on incomes starting at $14,383. A graduated tax is a tax on everyone.”

All 44 members of the Illinois House Republican Caucus are co-sponsors of HR 153. Representative Sosnowski serves the 69thDistrict, which includes portions of Boone and Winnebago Counties.

# # #